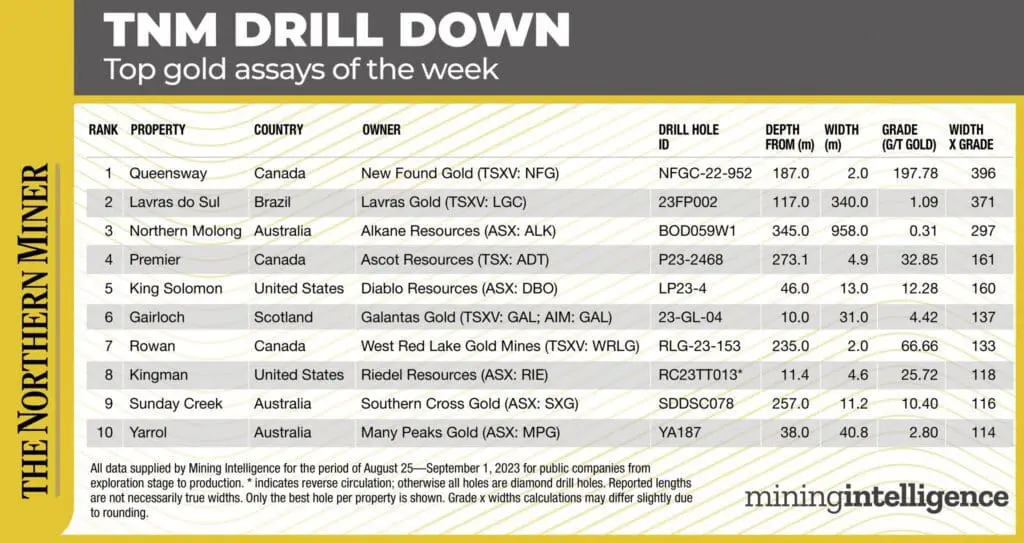

The top gold assays from Aug. 25-Sept. 1 come from Canada, Brazil and Australia. Drill holes are ranked by gold grade x width, as identified by our data provider Costmine Intelligence.

New Found Gold’s K2 Zone

New Found Gold (TSX-V: NFG) produced the best drill intercept for the week at its Queensway project in Newfoundland. The junior reported on Aug. 28 that hole NFGC-22-952 cut 2 metres grading 197.78 grams gold per tonne from 187 metres depth for a width x grade value of 396.

The results stem from 36 diamond drill holes completed to expand on the May K2 Zone discovery 725 metres north of the Lotto and 2.2 km north of the Keats West deposits on the west side of the prospective Appleton Fault Zone. Drilling at K2 encountered a gold-bearing structural zone with a large and growing footprint that includes an array of veining and strongly associated high gold grades.

Like Keats West, K2 is located west of the AFZ and gold is generally hosted in a low-angle, gently dipping structure, with most mineralization found close to surface.

With minimal drilling into this new zone, vice president for exploration Melissa Render says it is becoming apparent that the complexity and sheer number of associated veins at K2 far exceeds the system at Keats West.

Lavras Gold in Brazil

Brazil-focused Lavras Gold (TSX-V: LGC) reported the second-best drill hit for the week from its Lavras do Sul project in Rio Grande state. Hole 23FP002 returned 340 metres grading 1.09 grams gold per tonne from a depth of 117 metres.

This translates to a width x grade value of 371. The hole tested an unseen target in an area with no clear mineral signs, located in a lower-lying land area along a northeast-oriented fault. The company says the drilling confirmed the presence of long, continuous bulk tonnage-style gold mineralization in an intrusive-hosted gold system.

The hole was drilled at the new Fazenda do Posto target, 150 metres west of the Butiá deposit, which has an established global resource of 500,000 oz. gold. The measured and indicated resource totals 12.9 million tonnes grading 0.91 gram gold for 376,751 ounces.

The company believes the blind discovery opens up new exploration potential. Two drill rigs are now in the area following up.

Alkane Resources in NSW

Australia-based Alkane Resources (ASX: ALK) reported the week’s third-best drill intercept from its Northern Molong project in New South Wales. The company said on Aug. 25 that hole BOD059W1 cut 958 metres grading 0.31 gram gold per tonne from 345 metres depth for a width x grade value of 297.

The drill program extends over 5 km from Kaiser to Boda, through Boda 2 & 3 and south to Boda 4 deposits.

The company believes this system has the potential to be a large, tier-one gold-copper project. Alkane’s MD Nic Earner said in a release drilling at Boda has focused on increasing drill density to lift resource grade, expand tonnage, and identify further high-grade zones.

The company remains on track to deliver a resource update for the Boda deposit before year-end, and for the neighbouring Kaiser deposit in the New Year.