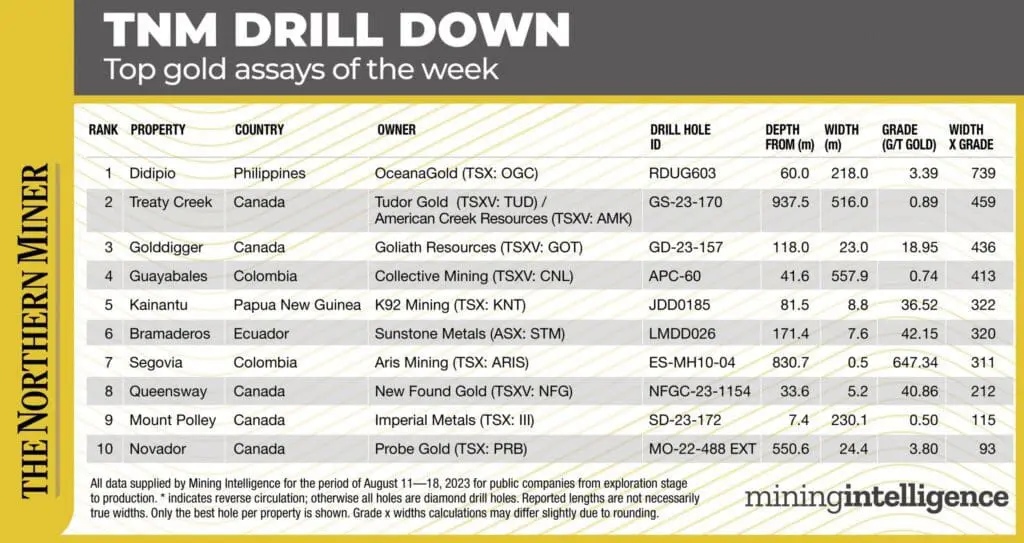

The Drill Down features highlights of the top gold assays from Aug. 11-18. Drill holes are ranked by gold grade x width, as identified by CostMine Intelligence.

OceanaGold (TSX: OGC) reported this week’s top drill assay, cutting 218 metres grading 3.39 grams gold per tonne from 60 metres depth, for a width x grade value of 739 in hole RDUG603 at its Didipio operation in the Philippines. Extension drilling has identified new areas of porphyry gold-copper mineralization 100 metres below existing inferred resources. It sits within the previously untested Didipio Deeps target, extensions of the Balut Dyke to the west, and depth extensions of known mineralization within the Eastern Breccia, which all remain open for extension beyond the existing resource.

Resource conversion drilling of the inferred resources, using the same holes as the extensional drilling, has also returned high-grade gold-copper in the Balut Dyke and is in line with historic drilling within the resource model shell. As of March 31, Didipio hosts an underground inferred resource of 15 million tonnes grading 0.87 grams gold per tonne for 430,000 ounces. Since December, the company has completed 9,172 metres of resource conversion and extension drilling in 45 holes out of a planned 20,250-metre program.

Ranking second is Tudor Gold (TSX-V: TUD) and American Creek Resources’ (TSX-V: AMK) 60-40-owned Treaty Creek joint-venture project in British Columbia, with a width x grade value of 459. Hole GS-23-170 returned 516 metres grading 0.89 grams gold per tonne from 937.5 metres depth. According to the company, the hole was designed to expand the northern extent of the CS-600 domain. This intercept represents a wider-than-expected interval within the northern aspect of the CS-600 Domain and includes an enriched section measuring 90 metres grading 1.93 gram gold per tonne.

Tudor, which acts as the project operator, said it aims to increase the deposit size while maintaining a good grade. Once the deposit is fully defined, it will conduct a preliminary economic assessment as a first step toward determining the economic viability of the deposit.

Goliath Resources (TSX-V: GOT) reported the week’s third-best assay result from its Golddigger project in B.C. On Aug. 15, the company reported that hole GD-23-157 returned 23 metres grading 18.95 grams gold per tonne from 118 metres depth, for a width x grade value of 436. The company interprets the intercept as the Surebet Zone from 117-139.20 metres and is one of five intervals encountered in this hole. Assays are pending for the remaining four intercepts, which include the Bonanza Shear.

Goliath says all 65 holes drilled on Surebet have hit mineralization, with 25 holes returning visible gold over a 1.6 sq. km area. The 2023 drill campaign includes 70 holes from 21 separate drill pad locations with four diamond drill rigs for a planned 18,000 meters. The program will also for the first time look at the recently discovered Goldswarm Zone.