When it comes to understanding processing costs, electric power is one of the cost centers that can have a real impact on operating costs.

Recently, Costmine released its Electric Power study for Mining Cost Service. It is remarkable how variable the industrial electric power costs are depending on region. In the lower 48 United States, electric power costs can range from $0.056 per kilowatt hour (/kWh) in Louisiana to over three times that ($0.191/kWh) in Rhode Island. In Alaska, the cost of power is solely dependent on whether you have access to a grid, or have to generate your own power. On grid, power costs are currently averaging $0.187/kWh for industrial use, however, diesel-generated power can be many times that. For example, in remote locations in Alaska, power rates are reported to be between $0.40/kWh to over $1.00/kWh, most likely with government subsidies.

For this Insight, Costmine examined the impact on the operating cost for a metric tonne of ore processed at a 10,000 tonne per day mill with a single flotation process. The base project will be calculated using $0.06/KWh; $0.08/KWh; $0.20/KWh; $0.60/KWh and $0.80/KWh. The average industrial power rate for 2023 in the U.S. was $0.0806.

This model was calculated using Sherpa Mineral Processing with Costmine’s 2023 dataset. The commodity used is typical of a massive sulfide deposit using a grade of 3% copper. We broke out the costs per tonne of processed ore below by major cost center. The table shows the comparison between the different electric power rates. Note that Labor and Supplies do not change and the electric power costs impact both the equipment operation and the miscellaneous categories.

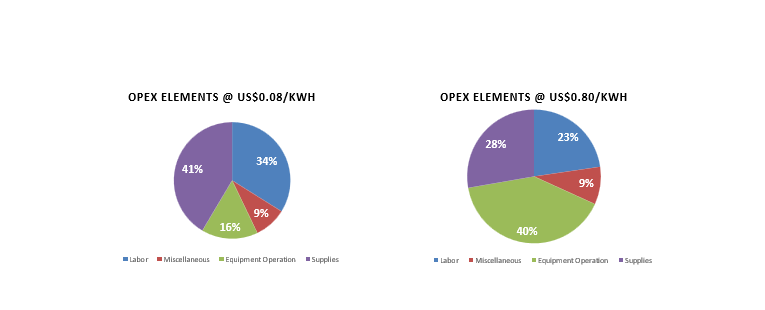

The following charts compare the impact on the relative importance of each cost element as power prices increase from $0.08/kWh to $0.80kWh. As rates increase, it brings into sharp relief the equipment opex for furnaces, crushers, grinders and other power intensive processes.

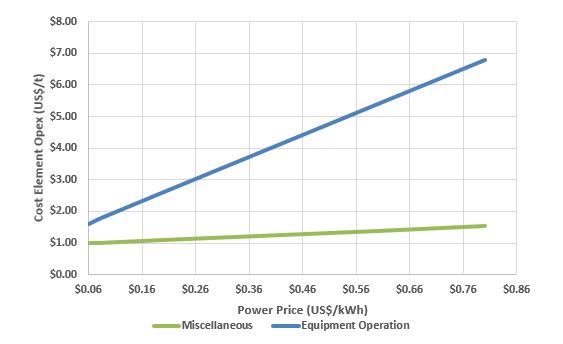

Another way to visualize this is to examine the sensitivity of Equipment opex to the price of electricity at an operation. For our standard single flotation processing facility, opex cost sensitivity due to power prices variation is significant but also not surprising. But here we are better able to quantify this sensitivity:

Sensitivity of Equipment and Miscellaneous opex to power prices

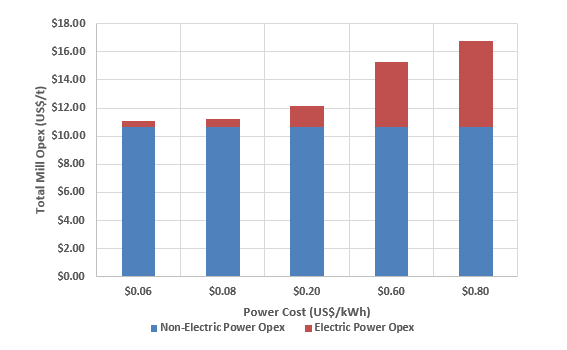

Using Costmine’s Sherpa Mineral Processing cost model to isolate the electric power consumed, the chart below makes it clear that the cost of electricity at mills can make or break many projects. As shown, prices above US$0.20/kWh makes power a significant portion of a mill’s opex.

Total Mill Opex, breaking out Power and Non-Power elements

The impact that electric power rates have is significant. As a result, companies are looking at alternative ways to generate power, particularly at remote sites. Some of the obvious options include natural gas generation where local supply is available, as well as wind and solar. Another of the more innovative options are small modular nuclear reactors (SMRs) that can be transported in standard 40-foot shipping containers. Indeed, this last option is being increasingly discussed amongst Costmine’s clients as an economically viable option for remote and northern mine sites. As the cost of carbon factors into more mines’ opex considerations this option will become increasingly compelling.

In conclusion, Costmine’s Sherpa cost model is the perfect tool to model alternative electric power scenarios and can

also help determine the viability of projects and alternate power generation.

Learn more about Sherpa Mineral Processing here: SHERPA Mineral Processing | Costmine Intelligence