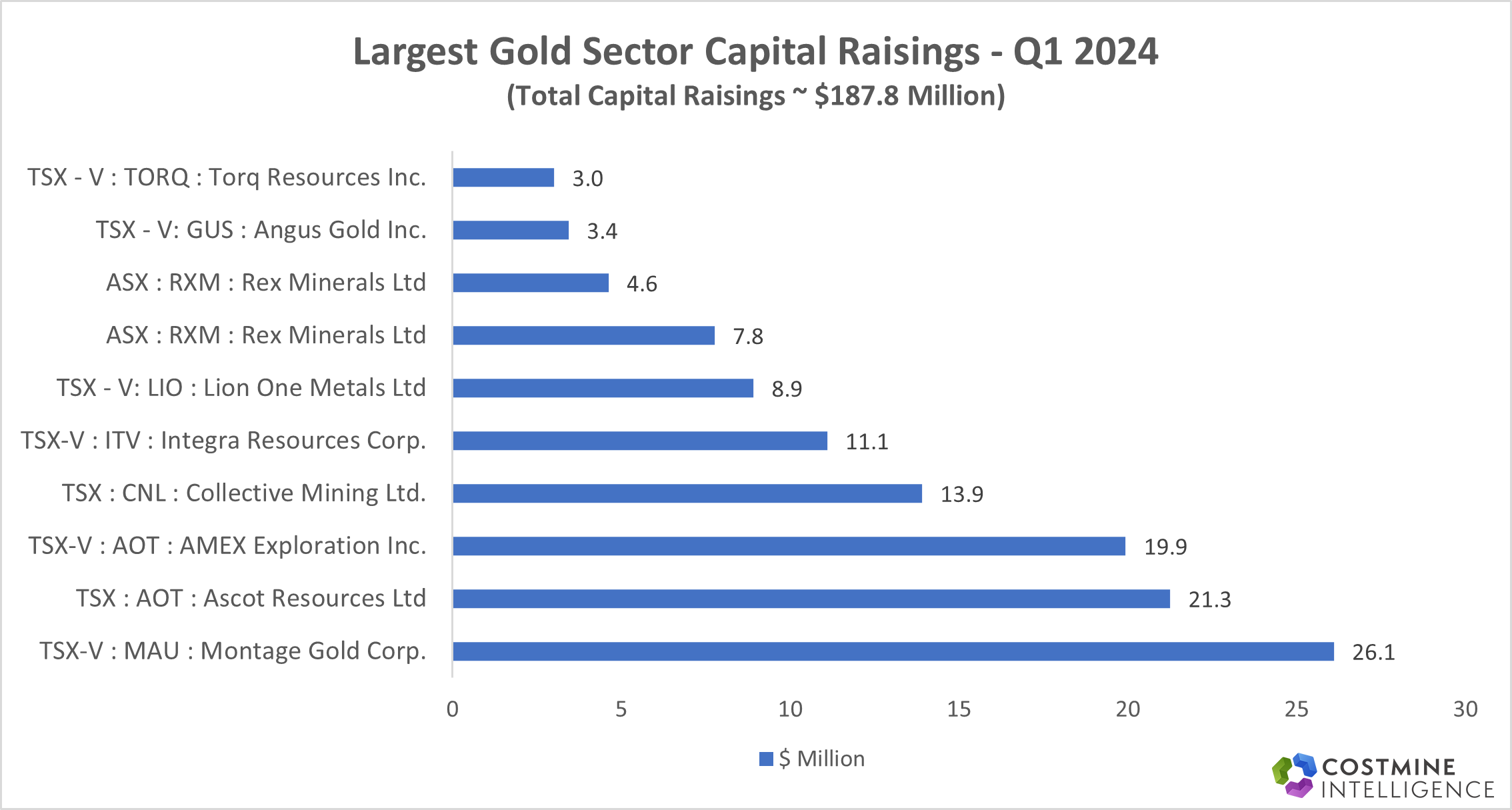

During Q1 2024, Costmine Intelligence tracked 26 closed gold mining financings that amounted to ~ $187.8 million.

Source – Mining Intelligence

1) Montage Gold Corp. (TSX – V: MAU) – (Property: Kone/Moron) – The company announced the expansion of its leadership team along with a $26.1 million non-brokered financing, including a strategic investment by the Lundin Family Trusts to increase their stake to 19.9%, as the company embarks on its strategy of creating a leading multi-asset gold producer focussed on Africa.

2) Ascot Resources Ltd. (TSX – AOT) – (Property: Premier) – The company has entered into an agreement with a syndicate of underwriters co-led by BMO Capital Markets and Desjardins Capital Markets, under which the Underwriters have agreed to buy, on a bought deal basis by way of private placement, 56,820,000 Common Shares of the Company at a price of C$0.44 per Common Share for gross proceeds of approximately C$25 million ($21.3 million).

#3) AMEX Exploration Inc. (TSX-V: AOT) – (Property: Perron) – The investment represents a strong endorsement of the work conducted at Perron project and leaves the company well capitalized to pursue a dual strategy of advancing known zones of gold mineralization and exploring significant exploration potential.

#4) Collective Mining Ltd. (TSX: CNL) – (Property: Guayabales) – The company announced the closing of C$18.9 million strategic investment by a single purchaser on a non-brokered private placement basis consisting of the sale of 4,500,000 units at a price of $4.20 per unit for gross proceeds of $13.9 million. The proceeds of the offering will be used for exploration on the Company’s properties in Colombia and for general working capital purposes.

#5) Integra Resources Corp. (TSX-V: ITV) – (Property: DeLamar) – The company intends to use the net proceeds to fund exploration and development expenditures at the DeLamar Project, the Nevada North Project and for working capital and general corporate purposes.

#6) Lion One Metals Ltd. (TSX-V: LIO) – (Property: Tuvatu) – The net proceeds received by the company will be used for development and ramp up expenses at the Tuvatu Gold project located in Fiji, as well as for general corporate expenses & purposes.

#7) REX Minerals Ltd. (ASX: RXM) – (Property: Hillside I Hog Ranch) – The company plans to use the proceed of the placement and entitlement offer principally for working capital purposes to fund the Hillside’s Final Investment Decision including pre-construction works at the Hillside Project. In addition, the company plans to add further value by finalising the exploration permitting at the Hog Ranch Project.

#8) Angus Gold Inc. (TSX-V: GUS) – (Property: Golden Sky) – The gross proceeds from the offering will be used by the Company to incur eligible “Canadian exploration expenses” that qualify as “flow through mining expenditures” as such terms are defined in the Income Tax Act (Canada) (the Qualifying Expenditures) related to the Company’s mineral projects in Ontario on or before December 31, 2025. All qualifying expenditures will be renounced in favour of the subscribers of the FT Units with an effective date not later than December 31, 2024.

#9) Torq Resources Inc. (TSX-V: TORQ) – (Property: Santa Cecilia Project) – The net proceeds from the offering will be used for exploration of the Company’s Santa Cecilia project and for general corporate and working capital purposes.