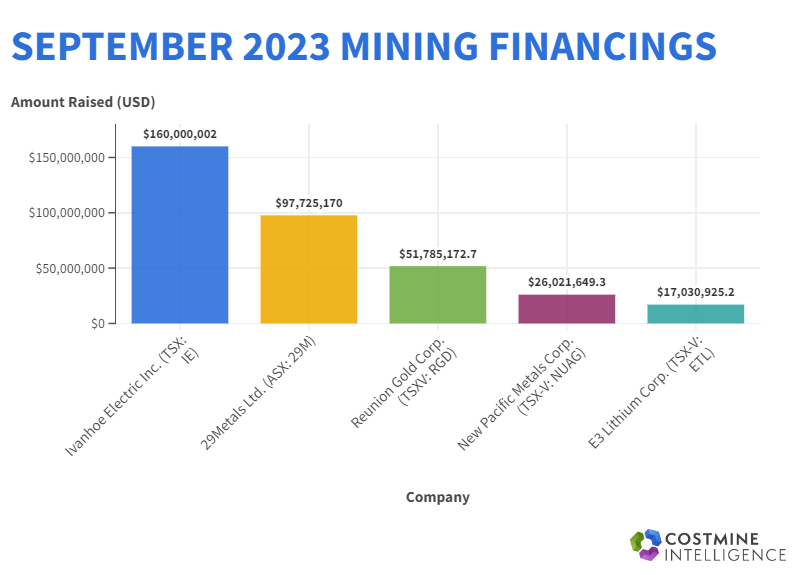

Each month Costmine Intelligence tracks the top mining financings around the world. In October, there were 35 financings closed that amounted to USD $196,268,265.

#1) Denison Mines Corp. (TSX: DML) intends to use the proceeds to finance: (1) the advancement of the proposed Phoenix in situ recovery uranium mining operation at Denison’s Wheeler River project, (2) exploration and evaluation expenditures; and (3) general corporate and administrative expenses, including those in support of corporate development activities.

Based upon preliminary budgets and plans, Denison expects the funds, taken together with existing financial resources, including those from prior prospectus financings, will be sufficient to advance the Phoenix project to a final investment decision and into the project execution phase.

#2) Uranium Royalty (TSX: URM) plans to use the proceeds to fund future purchases of physical uranium by the company, for potential acquisitions of uranium royalty, stream or similar interests and for general working capital purposes.

#3) Talon Metals Corp. (TSX: TLO) intends to use the proceeds of the Investment for further exploration, to progress its feasibility study in respect of the Tamarack Nickel Project and the Battery Minerals Processing Facility in North Dakota and to progress the environmental review process towards permitting for the Tamarack Nickel Project and the Battery Minerals Processing Facility in North Dakota, and for general corporate and working capital purposes. Talon also signed an agreement with the United States Department of Energy setting the terms, conditions and performance milestones for $114,846,344 (U.S.) in grant funding.

#4) EMP Metals (CSE: EMPS) proceeds from the sale of the HD units will be used by the company for drilling wells and other exploration work on the EMP project, Saskatchewan, and for general corporate and working capital purposes.

#5) Wallbridge Mining Corp. (TSX: WM), with the net proceeds from these private placements, expects to have an estimated year-end cash balance of approximately $25-million, which is sufficient to finance the 2024 exploration program on the company’s Detour-Fenelon gold property, as currently contemplated. The company will announce details of its exploration plans in January once board approval has been obtained.