Through our Mining Intelligence database, we meticulously tracked 941 private placement capital raisings across the Metals and Mining sector throughout the eventful year of 2023. This comprehensive tracking revealed a substantial deal value totaling approximately ~$5 billion, highlighting the industry’s robust activity in securing capital investments.

Regional Focus: Top Destinations for Private Placements Among the provinces and states that stood out as favored destinations for private placement deals were:

- British Columbia (Canada)

- New South Wales (Australia)

- Ontario (Canada)

These regions emerged as hotspots, attracting a significant portion of the industry’s attention. Impressively, a staggering 79% of all tracked private placements, totaling 744 deals, were concentrated in these three prominent areas alone.

The combined deal value stemming from British Columbia, New South Wales, and Ontario amounted to approximately ~$3,954 million, reflecting the substantial investment activity in these strategic locations.

In-Depth Analysis: Unveiling Top Performers and Deal Sizes In addition to tracking the overall landscape, Mining Intelligence delved into the specifics of the largest private placement capital raisings across these top provinces and states. Our analysis highlighted the Top 10 private placement deals in British Columbia, New South Wales, and Ontario for the year 2023, providing valuable insights into the industry’s key players and transactions.

Furthermore, our meticulous tracking extended to the range of deal sizes within the private placement sphere. From the smallest deals, typically falling between $10,000 – $100,000, to the most substantial investments exceeding $5,000,000, Mining Intelligence uncovered a spectrum of transaction sizes.

Key Findings:

- The deal size segment ranging from $1,000,000 – $2,000,000 emerged as a frontrunner, witnessing the highest deal traction. This segment accounted for a robust value of $208.3 million across 143 deals, underscoring the industry’s appetite for mid-range capital investments.

This comprehensive analysis sheds light on the dynamic landscape of private placements within the Metals and Mining sector, offering valuable insights for industry stakeholders and investors alike.

Navigating the Shifts in Mining Deal Activities

Deal activity in the mining sector saw a decline during the pandemic, both in frequency and size. Post-pandemic, while activity continued its descent, the total value soared to approximately $5 billion. This surge, which encompassed 10,000 deals, was predominantly led by gold deals, with the exception being BHP’s acquisition of Oz Minerals.

The driving force behind this trend? Price played a pivotal role, with fewer deals executed but at higher implied prices. This dynamic was fueled by a mix of factors, including optimism for the Energy Transition, particularly in the case of copper, and a broader trend of industry consolidation, especially evident in gold deals.

Looking ahead, the looming question is the impact of soaring gold prices on potential buyers. Will these high prices, hovering at around $2,000 per ounce, deter investment, or will the “fear factor” persist, keeping buyers enthusiastic? Similarly, for copper, priced at approximately $4.50 per pound, will the industry see a retreat due to high prices, or will the “fear of missing out” drive a flurry of new deals?

These questions mark the crossroads of the mining sector, where the interplay of market forces and strategic decision-making will shape the industry’s trajectory in the coming months.

Riding the Wave of Energy Transition: A Focus on Nickel

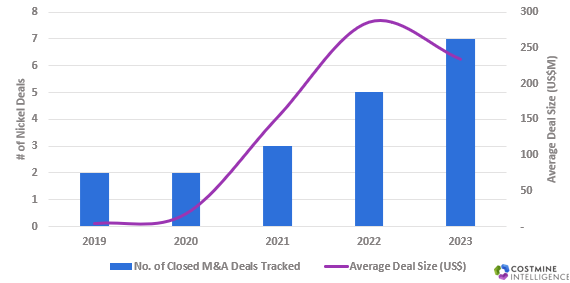

During the pandemic, the enthusiasm for Energy Transition metals surged, notably in the case of nickel. Despite nickel’s price remaining stable, comparable to 2021 levels, there has been a dramatic increase in both the number of deals and, importantly, the average value of these transactions.

A key driving factor behind this surge in interest is the rise in Indonesian nickel output. As Indonesia’s production has grown, so too has the attention on hard rock non-Indonesian assets. Western producers are increasingly turning their focus towards these assets, aiming to bolster their attributable output and capitalize on the growing demand for nickel in the Energy Transition era.

Overall, Mining Intelligence platform offers investors to analyze Global Capital Raisings activity across multiple financing types including private placement, initial public offering, rights offering and so on. In addition, each of these capital raisings are tagged to properties, commodities and can be analyzed on basis of deal status type (amended, proposed, closed, cancelled).

Deep dive into the Mining Intelligence platform and request a demo for further information on Capital Raisings Activity in the Metals and Mining Sector.